What is a credit score and how does it work?

Your credit score gives lenders an idea about how well you manage your finances.

What is a credit score?

Your credit score gives lenders a snapshot of how you manage credit, like credit cards, loans, and mortgages.

A ‘credit score’ is generated for you by UK credit reference agencies based on information held about you on public records, and supplied by credit and service providers.

Your credit score is then shown as a number. In basic terms, the higher your score, the more likely you are to be approved for credit, as it’s a reflection of how likely you are to repay any borrowing. Your credit score isn’t fixed and can change as your financial situation does.

In the UK, there are three main credit reference agencies. They might each hold different information about you and have different ways of working out a credit score for you. Individual lenders and service providers might use their own scoring systems too, which may include looking at information from your credit record. They may also take into account what you can afford and how you have paid previous accounts.

What is a credit score used for?

When you apply for a credit card or personal loan, for example, your credit record might be checked - or searched - by whoever you’re applying with. They’ll use their preferred credit reference agencies to do this, which will show them the potential risk of offering you credit.

Your credit record might also be used by lenders or service providers to decide what interest rate, loan amount, or credit limit to offer you.

Do lenders check anything else?

-

Excellent

Good

Fair

Poor

Very poor

Excellent

961 - 999

Good

881 - 960

Fair

721 - 880

Poor

561 - 720

Very poor

0 - 560

-

Excellent

Very good

Good

Poor

Very poor

Excellent

811 - 1000

Very good

671 - 810

Good

531 - 670

Poor

439 - 530

Very poor

0 - 438

|

Excellent |

Good |

Ok |

Needs some work |

Needs work |

|---|---|---|---|---|

|

Excellent 628 - 710 |

Good 604 - 627 |

Ok 566 - 603 |

Needs some work 551 - 565 |

Needs work 300 - 550 |

These could be different to the score lenders and service providers give you, as they also look at other information from your credit record and the details you provide them. However, your credit score is usually a fairly reliable indicator of your current financial position.

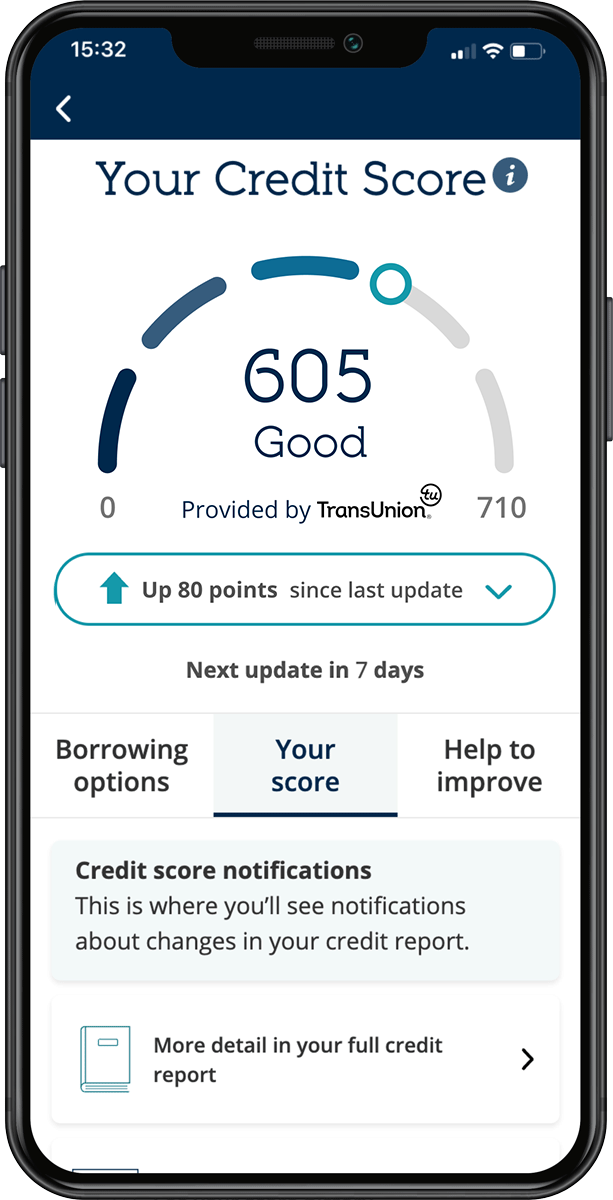

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help improve your score.

- Find out how your score compares to the UK average.