What is a balance transfer?

Moving an existing credit card (or store card) balance to a different credit card is a balance transfer.

Balance transfers can be useful when:

FAQs

-

At MBNA, subject to approval of your request, the transfer will normally arrive by the next working day. Working days do not include weekends or bank holidays.

-

The minimum with us is £100 and the maximum is 93% of your credit limit to allow for any balance transfer fee and any other fees, as well as charges or transactions which haven’t yet reached your account.

-

You’ll need the details of your credit or store card and the current, total balance. If you’re transferring to us and have an account with us already, you’ll need your log in details.

-

You can usually transfer from cards that have the Visa®, Mastercard® or American Express® logo.

-

Transferring a balance could change your credit score if you’re taking out a new card, as it increases the level of credit available to you.

Keep reading

Know where you stand with MBNA

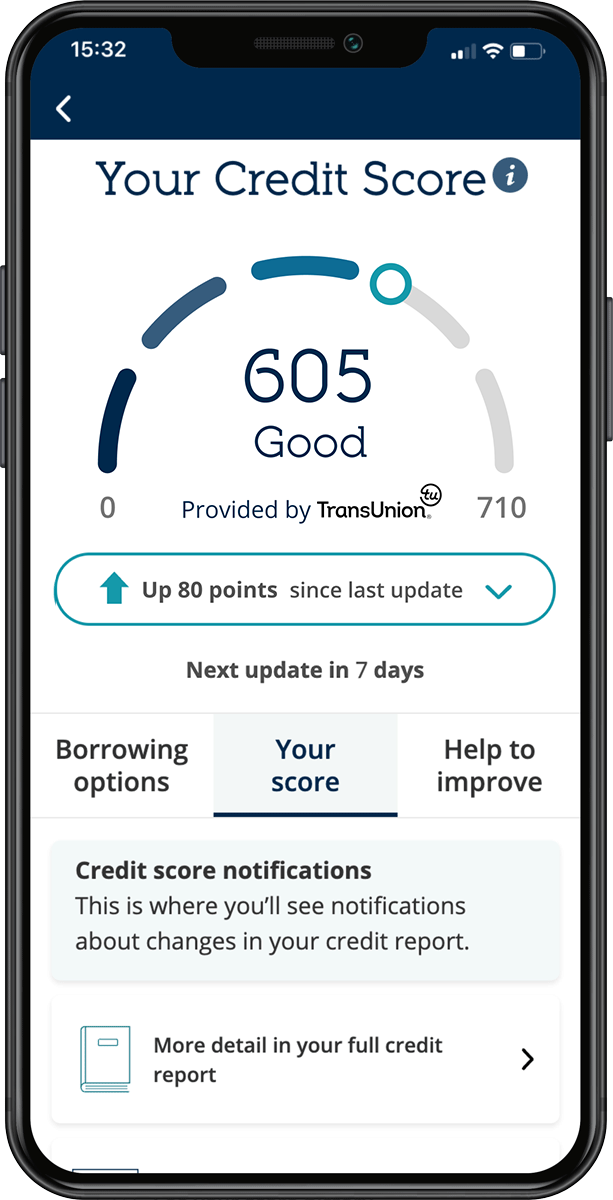

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.