What is a money transfer?

Moving money from your credit card to a UK bank account is called a money transfer.

Money transfers can be useful:

- When it’s not possible to pay by credit card. For cash purchases only.

- For large or unexpected purchases. To spread the cost of a payment but can’t use a credit card to pay for it.

FAQs

-

At MBNA, subject to the approval of your request, the transfer will normally arrive by the next working day. Working days do not include weekends or bank holidays.

-

The minimum with us is £100 and the maximum is 93% of your credit limit to allow for any money transfer fee, as well as any other fees, charges or transactions which haven't yet reached your account.

-

You’ll need the details of your UK current account, including the account number and sort code, and to know how much you want to transfer.

-

No. If you transfer money to a bank account, then the purchases made using that money are not covered under Section 75 of the Consumer Credit Act 1974, unlike most credit card purchases.

Keep reading

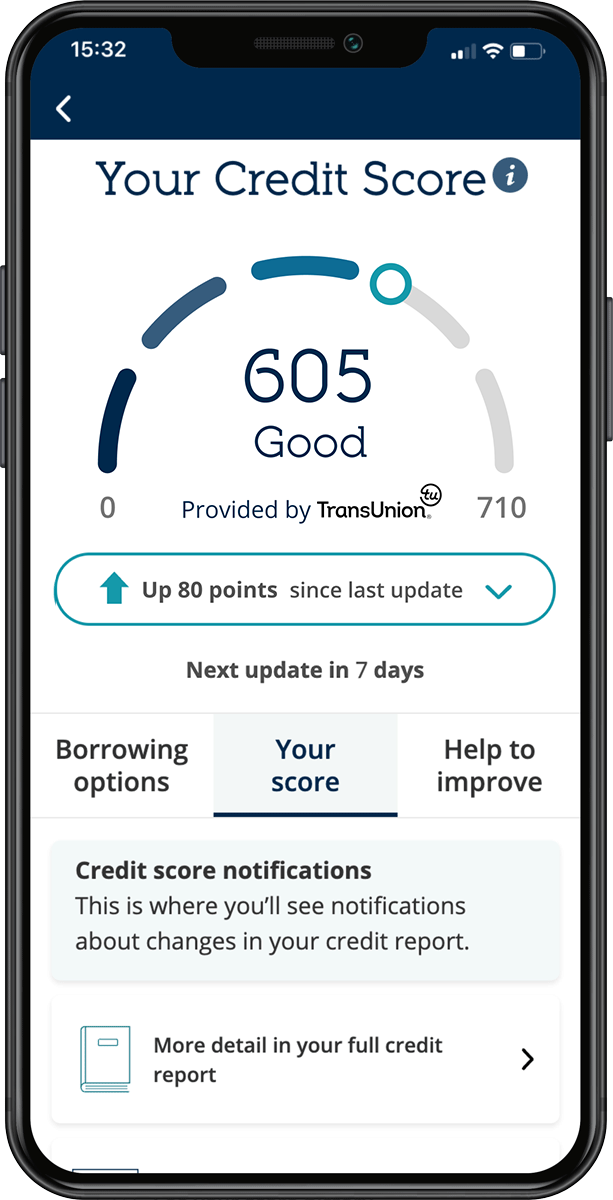

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t hurt your credit file.

- Your score will be refreshed every 7 days to help you stay on top of your finances.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.