How to consolidate debt

Debt consolidation is when you combine lots of existing debts into one.

Why consolidate debt?

With lots of borrowing options, it’s possible to have multiple debit balances and multiple regular payments, for example on credit cards, store cards, loans and car finance. This can be confusing when you have different interest rates on each account.

It could be easier to manage payments and keep track of your borrowing costs, with everything in one place.

It’s important to note that all lending is subject to an assessment of your financial circumstances and what you can afford. Depending on your individual circumstances, your interest rate and your overall borrowing costs could be higher, and it may take you longer to pay off your debt.

There are a few ways to consolidate debt

-

A family member or close friend may be able to lend you the money.

It’s a good idea to write an agreement that clearly states the terms of the loan, how much you’ll be borrowing and how you will repay it.

Borrowing from family isn’t an option that’s available to all, and it’s worth thinking about how it will impact your relationship if, for example, you fail to repay on time. There may be other borrowing options that are more suitable.

-

Loans called debt consolidation loans involve borrowing credit from one lender to pay off multiple debts. It leaves you with one payment each month. If you’re approved for this kind of loan, then the money is deposited in your chosen account for you to repay your existing balances.

Usually the loan repayment terms range from 1-7 years, after which your balance will be repaid in full, as long as you’ve made all of the agreed payments.

Things to think about before applying:

- The amount you’ll need to cover the cost of all your debt. You might need to take into consideration any charges or fees, like early repayment fees.

- If you have credit with a promotional interest rate, such as 0% interest, is it worth waiting until the offer expires before refinancing?

- Is the consolidation loan secured against your home or another possession. You could lose your home or the belonging that it is secured against if you don’t keep up the repayments.

- Are you eligible for additional credit? Some lenders will offer an eligibility check to help you understand if and what you could borrow.

- Will the interest rate be fixed? If it is, then your monthly repayments will be a fixed amount, helping you to keep track of your money. If the interest rate is variable then your loan repayments could increase or decrease.

- Consolidating debts for lower monthly repayments could mean that is takes longer to repay. It could end up costing more in the long run.

- Always make sure you can afford the repayments. Help to know what you can afford.

You can get an idea of monthly payments by using our loan calculator.

-

Credit cards can be used in different ways to consolidate debt: using balance transfers or money transfers.

A balance transfer involves moving existing card balances onto a credit card.

A credit card with a lower interest rate could reduce your borrowing costs. Balance transfers often come with transfer fees. Make sure you’re clear on all the additional costs and fees that come with moving credit.

A money transfer involves moving funds from a credit card to your UK bank account.

Money transfers can be useful to consolidate other debit balances which can’t be transferred, for example some personal loans or store cards.

As with a balance transfer, fees and costs may apply. It’s worth noting that purchases made using debit cards, bank transfer, money transfer or cash aren’t covered by Section 75 of the Consumer Credit Act, like some credit card purchases are.

Payments for credit cards

When it comes to making payments, credit cards do not have a fixed term agreement or set monthly repayments, like loans often do, so it could be harder to budget. However, it’s usual to be able to pay more than the minimum repayments, as and when you want to – helping to reduce the balance without paying early repayment fees.

Some transfers come with a promotional rate such as a 0% interest for a set period of time. Repaying balances before this period ends can help to limit borrowing costs. But remember, if you miss a payment, you could lose any promotional offers.

Things to think about before applying:

- How much credit do you need to cover your existing debit balances?

- Are there any early repayment charges on balances you hold elsewhere?

- Are you eligible to borrow? Some lenders have eligibility check tools so you can get an idea of your borrowing options.

- Can you afford the repayment? With a credit card, you’ll be expected to pay at least the minimum repayment each month. But if you only pay the minimum amount each month, it could take you longer to repay the overall balance and could cost you more in the long run.

-

You can consolidate debt by borrowing more on an existing mortgage.

Borrowing more on your mortgage depends on several things:

- Will your existing mortgage lender allow you to borrow more to cover debt?

- How many years your mortgage term is, and how old you are.

- Can you afford the monthly repayments?

- What is the loan to value ratio for your property?

- How long have you been paying your mortgage?

Don’t forget: Your mortgage is secured borrowing against your home. So, you could lose your home if you don’t keep up your repayments.

Secured borrowing usually has a lower interest rate than unsecured borrowing, such as a credit card. But it may be taken out over a longer period of time, and therefore could end up costing you more in the long run. Mortgage terms in the UK can span anything from a couple of years to 40 years.

If you’re thinking of changing your mortgage, it important to get financial advice. Speak to a qualified mortgage adviser before making any changes to your existing mortgage.

-

Equity release means releasing tax-free money from your home, without having to sell or move. It’s usually only available to homeowners over 55 years old.

It works like a loan that is secured against your home. You won’t have to repay the balance until you move into long-term care or you pass away.

If you’re considering this option, it’s important to speak to a financial adviser who can explain what’s involved, your options and risks.

Search for an independent financial adviser through MoneyHelper and the Equity Release Council.

-

If you're over 55 years old, you might be able to consolidate debts using a tax-free lump sum from your pension fund, if you have one.

Speak to a qualified pensions advisor who is regulated by the FCA (Financial Conduct Authority) about any changes to your pension fund, as anything you use now could mean you have less for your later years.

A quick recap

- Consolidating debt is combining lots of existing debts into one. It could make managing your money easier.

- Some of the most common ways to consolidate debt are by using a credit card or personal loan. But there are other ways to do it, too.

- It could simplify your borrowing costs, but there are also risks to consider. You might want to speak to an independent financial adviser before making a decision.

- If you’re worried about money, speak to someone. We’re here to help.

Keep reading

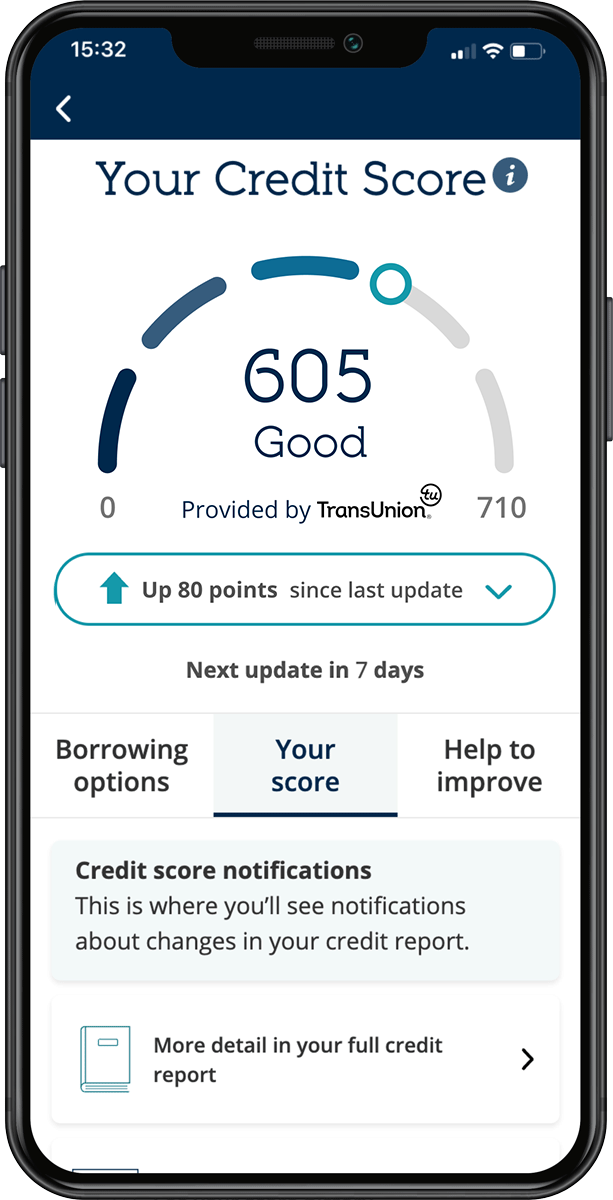

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t hurt your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.