Knowing what you can afford

If you’re planning on taking out credit, will your budget cover the repayments?

Budgeting

A budget can help you see what money you have coming in and going out every month – so you can get a clear picture of your finances.

Why budget?

A budget is not just for reducing debt. It can help you save, manage your money and plan for things like investments or taking out credit.

The aim of a budget isn’t to restrict your spending, but to help you make the most of your money.

A quick recap

Here’s what you’ve learnt about knowing your affordability:

- A budget can help you take control of your finances.

- List your incomings and outgoings to help you get a clear picture.

- One of the ways to reduce multiple debt repayments is by consolidating your debt.

- Lenders will check certain things about you and your history of borrowing.

Keep reading

Know where you stand with MBNA

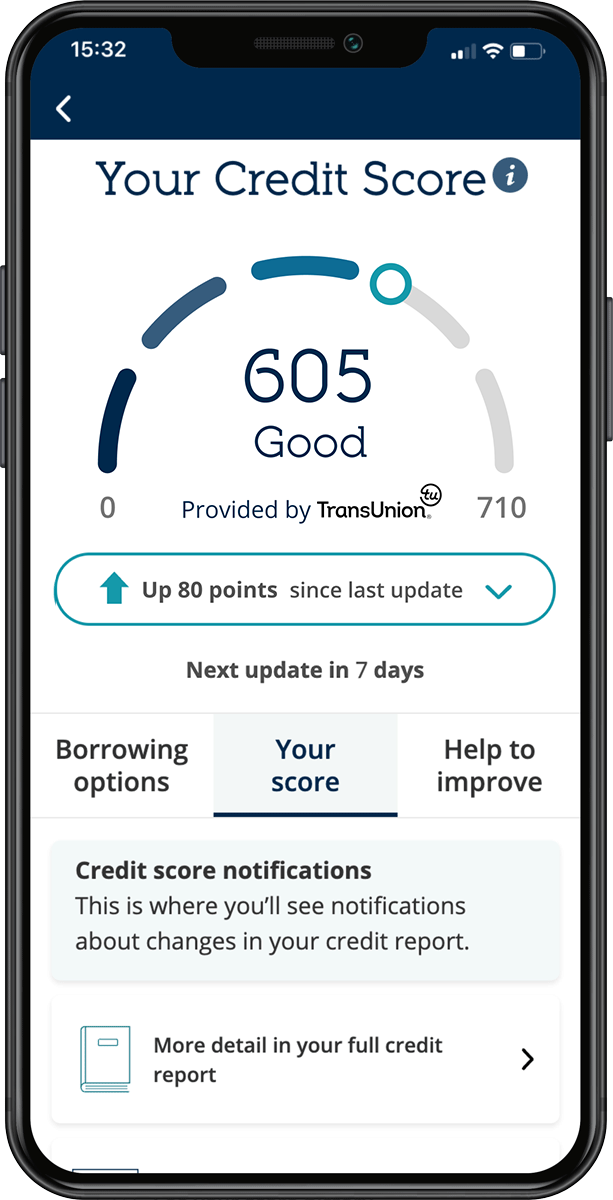

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.