What can impact your credit score?

You might be surprised by what can impact your credit score.

It’s not one-size-fits-all

With no one-size-fits-all scoring system, getting your head around your credit score can be confusing. So, we’re here to help.

In the UK, there are three main credit reference agencies: TransUnion, Experian and Equifax.

They each collect information about you from public records, lenders and other service providers. This information helps them build a picture to help them calculate your ‘credit score’.

Each credit reference agency does this independently, so the score they generate can vary too.

Other lenders and service providers also may have their own scoring systems, using information such as your application details, your credit report, any existing account information and when you last applied for credit.

Things that may impact your credit score

There are lots of things that may impact the credit score generated by each of the credit reference agencies. But how you manage your finances is a big factor. Things like:

Things that are unlikely to affect your credit score

Not everything affects your credit score. Some of the things that are unlikely to are:

Keep reading

Know where you stand with MBNA

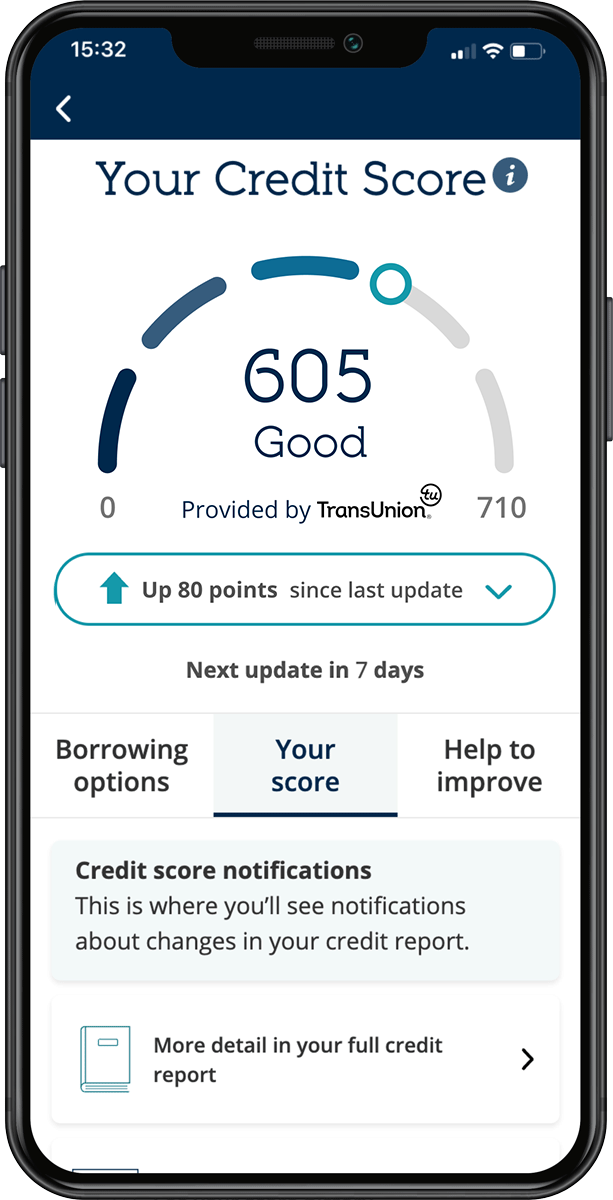

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t hurt your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.