What is a credit check?

Getting to know the difference between a soft credit check and a hard credit check.

A credit check builds a picture of your financial history.

Credit checks or searches are used by lenders and companies when you apply for credit. They will usually check your credit report to help build a snapshot of your financial history, as part of their assessment of your credit application.

A credit report is your history of your borrowing and how you manage your finances. How well you’ve managed debts, for example, is recorded on your credit report.

There are two kinds of credit checks:

Keep reading

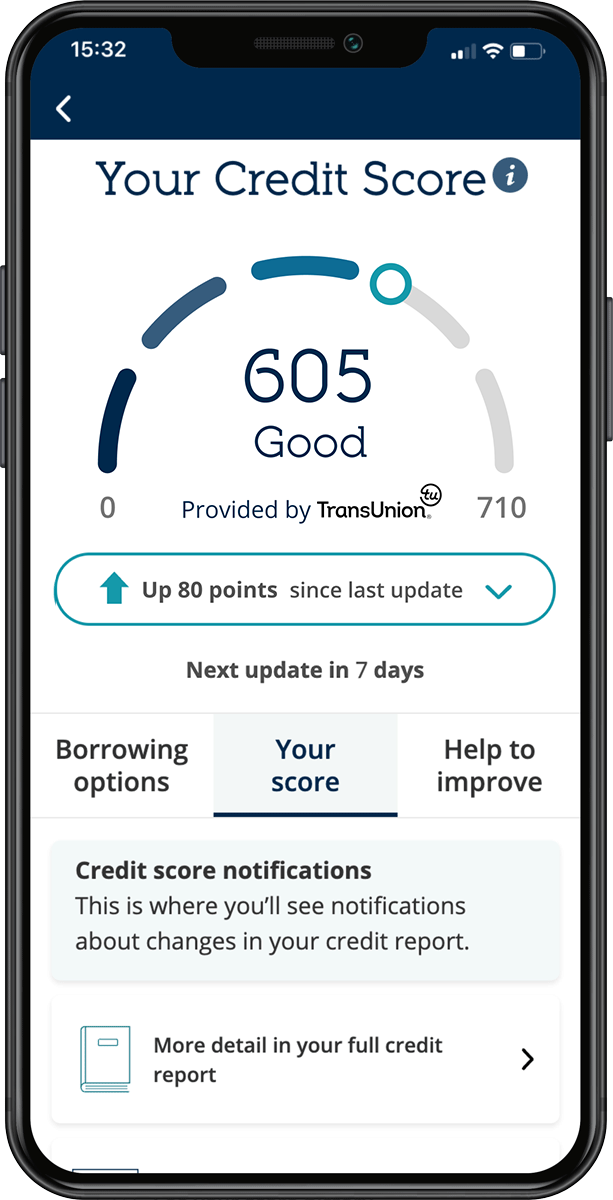

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.