How a credit card works

Understanding credit cards and how they work.

What is a credit card?

A credit card is a way of borrowing money. It allows you to pay for purchases using credit and repay the balance over time.

Repayments can be made in full at the end of the month or you can choose to spread the cost more flexibly over time.

Interest may be charged on the balance borrowed, unless an introductory offer or promotion is in place – and there may be additional costs for some transactions.

-

Helping you understand credit cards.

A credit card can help you pay for things your way.

Unlike your debit card, a credit card pays with borrowed money, which then needs to be paid back later.

You’ll be charged for borrowing in two ways:

Interest ... which will be a percentage of the money you borrow on your credit card.

And fees ... such as an annual fee or transfer fees ... or a charge for things like late payments.

A credit card comes with a credit limit – the maximum amount you can borrow with the card based on your circumstances … and your credit history.

You’ll have a minimum monthly repayment you’ll need to make – although you can vary how much you pay back each month above that amount.

Every month, you’ll get a credit card statement showing your balance, the minimum you need to pay and when to pay it by.

If you can pay off your entire balance before the due date, that’s great – you won’t pay any interest at all.

If you pay it back over a longer period, that’s fine too, but you’ll pay some interest … unless you have an interest-free offer.

Generally, the more you pay, the less the interest you’ll pay overall.

So it’s a good idea to pay off as much as possible, whenever you can.

If you already have borrowing, a balance transfer lets you move your balance from one credit card to another with a different provider.

This could mean moving to a card with a lower interest rate, which might reduce your monthly outgoings.

Credit cards also offer protection under Section 75 of the Consumer Credit Act.

This means you could get your money back if you run into a problem with most purchases over £100 up to £30,000.

The key points to remember when choosing a credit card are:

Be aware of interest charges and fees … and the more of your balance you pay off each month, the less interest you’ll pay.

So, think about what you want to use your credit card for and take your time to find the one that’s right for you.

MBNA – choices made simple.

Uses for a credit card

- To cover unexpected costs.

A credit card can offer a flexible way to pay for sudden costs, with the option to repay the balance over time. - Making purchases.

Using a credit card offers the option to spread the cost of purchases. So you could pay for things like home improvements, family holidays, or your everyday spending and then repay straightaway, monthly or over a longer period.

- Purchase protection.

Most credit card purchases over £100 and up to £30,000 are covered under Section 75 of the Consumer Credit Act 1974. So, if your purchase is faulty, doesn’t arrive or isn’t as described you could be covered for all or part of the purchase price if you paid in full or part using a credit card. Learn more about Section 75. - Consolidating credit card balances.

A credit card can be a way of consolidating multiple outstanding credit card balances. Transferring balances to a single credit card could help manage monthly payments.

Credit card transactions

Fees and charges

If you're considering a Credit Card, it's a good idea to understand any fees and charges that may be payable. As well as interest on what you borrow, there may be other fees and charges. If you pay late or miss a payment, you may have to pay fees, lose any promotional offers you have, and it could damage your credit score.

Credit cards and credit scores

What is a credit score?

Your credit score is a number that gives lenders a snapshot of how you have managed finances, like credit cards, loans, and mortgages.

Why is a credit score important?

A credit score can give an indication of how likely you are to be able to repay borrowing.

When you apply for a credit card your credit file will usually be checked, or searched, by whoever you’re applying with. They’ll use their preferred credit reference agencies to do this, which will help show them how likely you are to repay what you’ve borrowed.

-

Helping you understand credit – what is a credit score?

If you’re applying for a credit card, personal loan or mortgage, lenders will usually check your credit file to:

assess your circumstances

highlight potential risks

decide on the interest rates and credit limit they’re prepared to offer.

So, if you have a good payment history on all your accounts and low outstanding debts, you may have a higher credit score … which means you’re more likely to be seen as a lower credit risk.

Usually, a higher credit score gives you a stronger chance of being approved for credit, with a higher credit limit and at a better interest rate.

To work out the risk of lending to you, a lender usually checks a number of things, such as:

details on your application form

how you’ve managed your accounts in the past

and information from credit reference agencies.

This is then taken into account as part of their ‘credit worthiness’ assessment. Then they’ll decide whether to lend to you, and on what terms.

Credit reference agencies usually hold information on people’s identity, address and personal financial history. They get some of their information from public records and other lenders.

Some ways you might be able to improve your credit score are:

make sure you’re on the electoral register

check that all your details are correct

manage your accounts effectively

pay bills and credit on time

don’t go over your credit limit

avoid applying for lots of credit in a short space of time.

Many lenders offer eligibility checkers. Ours is called Clever Check and it’s available online or on the MBNA Mobile App.

It can help you find out which credit cards you might be eligible for before you apply – without affecting your credit score – and there’s no obligation to apply for a credit card afterwards.

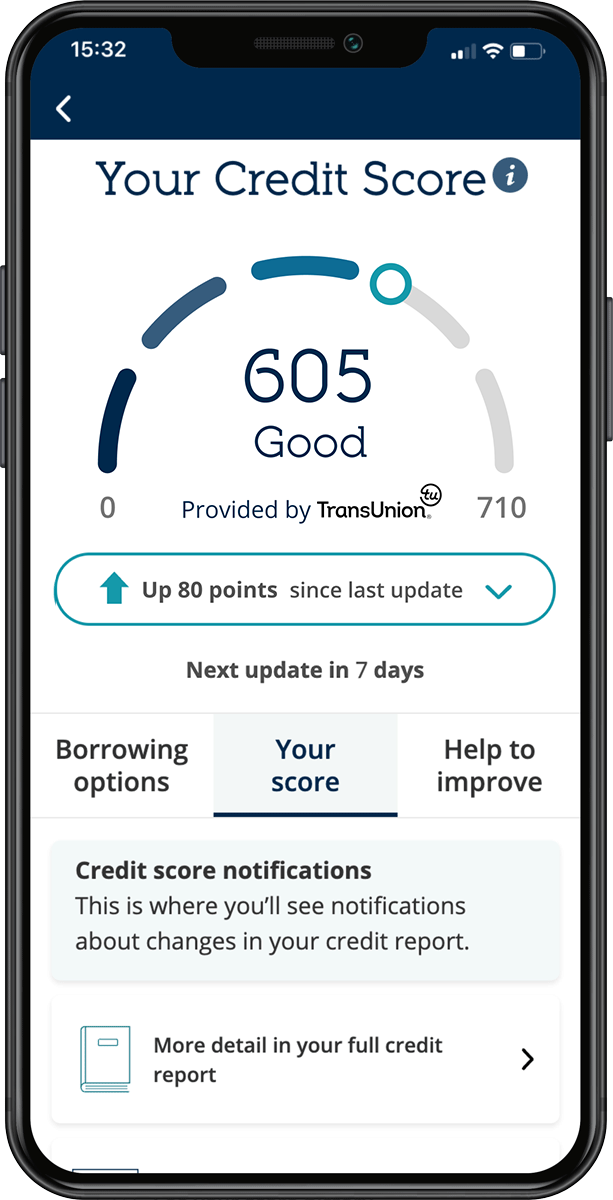

You can check your TransUnion credit score for free on the MBNA app, view your full credit report, and get regular hints and tips on how you could improve or maintain your score.

MBNA – choices made simple.

FAQs

-

A debit card is linked to your current account. When you use a debit card money is taken from your account balance. A credit card is a separate account which provides you with an agreed credit limit which you can spend up to. When you spend using a credit card this is taken from the available balance, and you’ll need to pay this back.

-

- Consider what you’ll use your credit card for. Credit cards can be used to help spread the cost of large purchases, for your everyday spending or to consolidate debt.

- Take a look at your options. What are your borrowing options? Is a credit card the most suitable choice for you?

- Compare credit card features. Different cards will suit different people, so consider the features to find the best match for you. Are there introductory offers? What are the fees and charges? How much interest will you be paying?

-

The amount available for you to borrow will be personal to you – it’s known as your credit limit. It’s usually based on your personal circumstances and how you’ve managed borrowing in the past. It can also change over time, so you may be able to increase and decrease your limit in future.

-

Most credit cards can be used abroad. It’s worth checking with the provider and making sure you understand any fees and charges associated with using your credit card outside of the UK. For example, it may be free to use for purchases but there may be a charge for withdrawing foreign currency from an ATM. There may also be currency conversion charges to consider.

-

Most credit card transactions are covered under Section 75, which protects purchases between £100 up to £30,000. If your purchase is faulty, doesn't arrive or isn't as described, you could be covered.

Learn more about Section 75 of the Consumer Credit Act 1974.

Keep reading

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.