What is credit?

What is credit and how does it work?

In a nutshell

Simply put, credit gives you access to money now and you agree to pay it back over time, usually with interest.

Credit can be useful if you’re planning a large purchase or as a way to consolidate existing debts.

How much it costs you to borrow money depends on a number of things, including how much you borrow, how long it will take to repay and the terms of your credit agreement.

Go to:

How credit works

Different types of credit

Where can you get credit

The difference between secured and unsecured borrowing

5 ways to manage credit

Secured borrowing is when the amount that you have borrowed is secured against a belonging, like your home or car like a mortgage or car finance. If you don’t make payments on time and uphold your agreement, you could lose your car or house.

The interest rates are usually lower than unsecured borrowing.

Unsecured borrowing isn’t secured against a belonging. Instead, an agreement is made with the lender for how you will repay the loan. Unsecured borrowing includes things like credit cards, loans and arranged overdrafts.

The interest rates for unsecured borrowing tend to be higher than for secured.

A quick recap

- Credit gives you the option to pay for something now and to repay that money over a period of time, usually with interest.

- Interest fees, charges and other costs may apply.

- There are lots of types of credit available, from unsecured borrowing such as personal loans and credit cards to secured credit, like a mortgage or car finance.

- You can check your credit score to give you an idea of whether lenders will offer you credit.

Keep reading

Know where you stand with MBNA

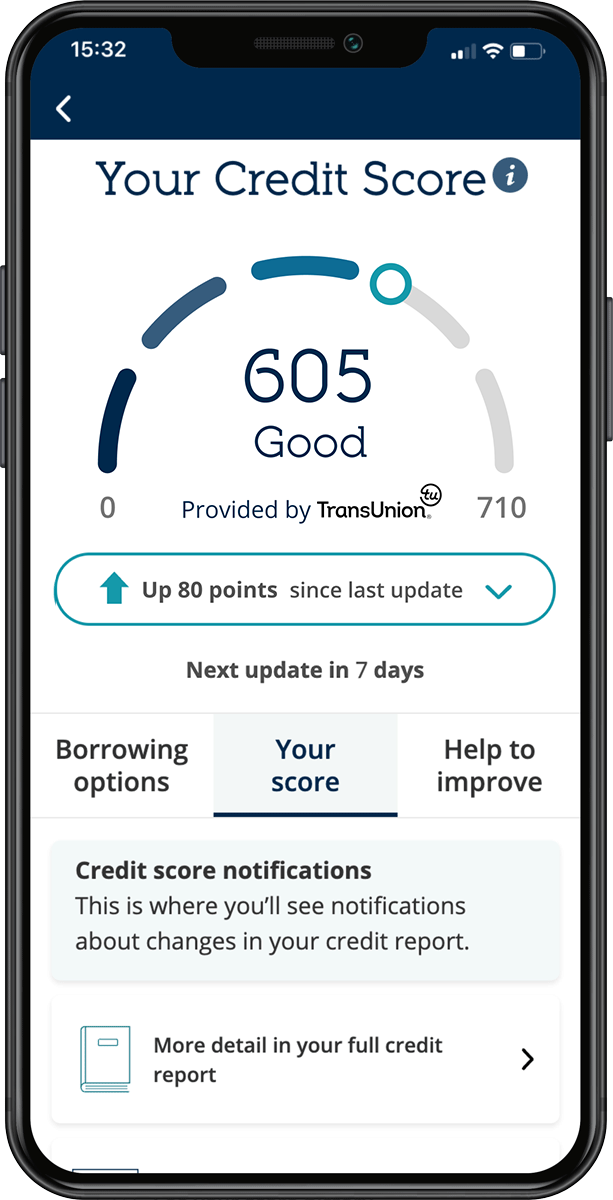

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.