What is an interest rate?

Interest could be paid to you when you save money or be a cost when you borrow. When you borrow money, whether that's in the form of a mortgage, credit card, personal loan, overdraft or car finance, you may need to pay a percentage of interest - essentially, a charge for borrowing money.

Interest when you borrow

Interest on borrowing is a cost.

When you borrow for things like a mortgage, a credit card, or a personal loan, you may also have to pay back a percentage of interest. Borrowing could include other fees and charges, as well as the amount of money you want to borrow.

Interest when you save

Interest on saving is a reward.

When you save money, your bank or other financial institution may pay you a percentage of interest. This is usually paid either monthly or yearly.

Compound interest

Compound interest is a bit more complicated. It includes interest earned or charged over time, not just the borrowing amount. Over time, compound interest could make a big difference to your savings or borrowing costs.

Here’s an example of compound interest on borrowing and savings of 2.5% a year:

|

Year |

Balance |

Interest per year |

Closing balance |

|---|---|---|---|

|

Year 1 |

Balance £1,000 |

Interest per year £25 |

Closing balance £1,025 |

|

Year 2 |

Balance £1,025 |

Interest per year £25.63 |

Closing balance £1,050.63 |

|

Year 3 |

Balance £1,050.63 |

Interest per year £26.26 |

Closing balance £1,076.89 |

This example assumes that no money has been deposited into the account or removed.

Different credit types can mean different interest…

A quick recap

Here’s what you’ve learnt about interest rates:

- Interest can earn you money on your savings, and cost you money when you borrow.

- The Bank of England Base Rate can influence the interest rates available for both savings and borrowing.

- There are both fixed and variable interest rates. Fixed rates are not impacted by changes to the Base Rate. Variable rates can go up and down.

- Interest rates are different for different credit types, and there may be other fees and charges to consider.

Keep reading

Know where you stand with MBNA

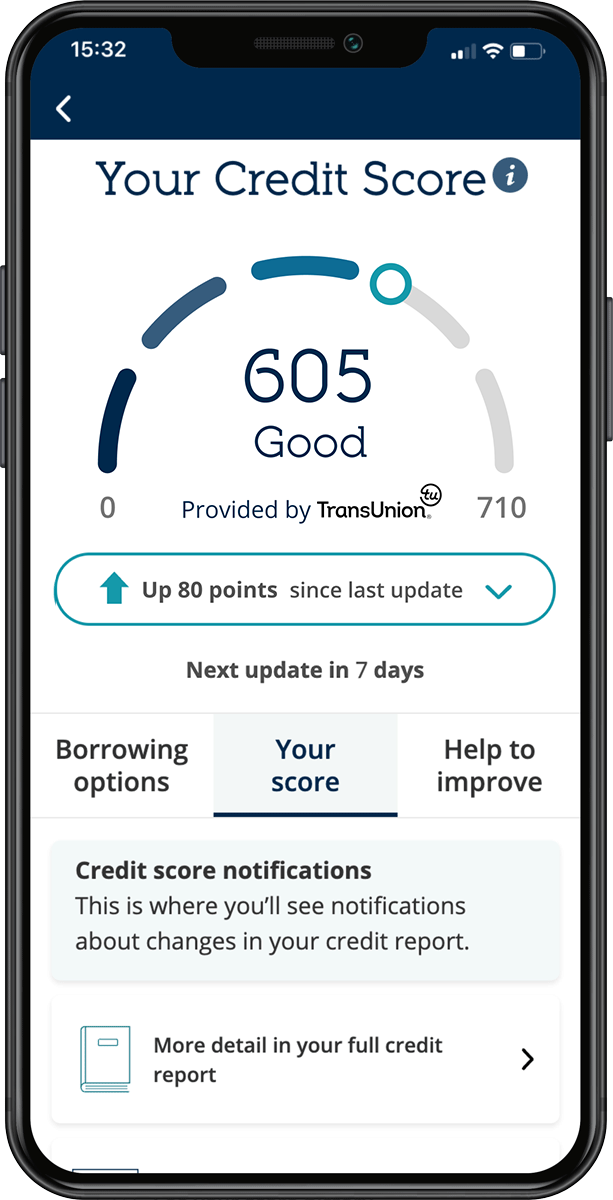

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.