How to improve your credit score

Why is a good credit score important?

- The higher credit score you have, the more likely it is an application for a credit card, personal loan, mortgage, overdraft or car finance etc. will be accepted.

- More favourable interest rates and terms might also be offered to lower risk applicants, with a proven history of paying credit well.

- Your credit score can also influence how much credit you’re offered.

- Bad credit might even affect you getting a job in certain sectors, like legal or financial services.

Can you improve your credit score quickly?

Building your credit score is something you can do over time. You’ll find some tips about how you can do this in the next section.

Be aware though, if you’ve had issues with credit previously, any Defaults, County Court Judgments (CCJs), Individual Voluntary Agreements (IVAs) and bankruptcies can affect your credit score for up to six years.

How do credit scores work?

Improving your credit score

Keep reading

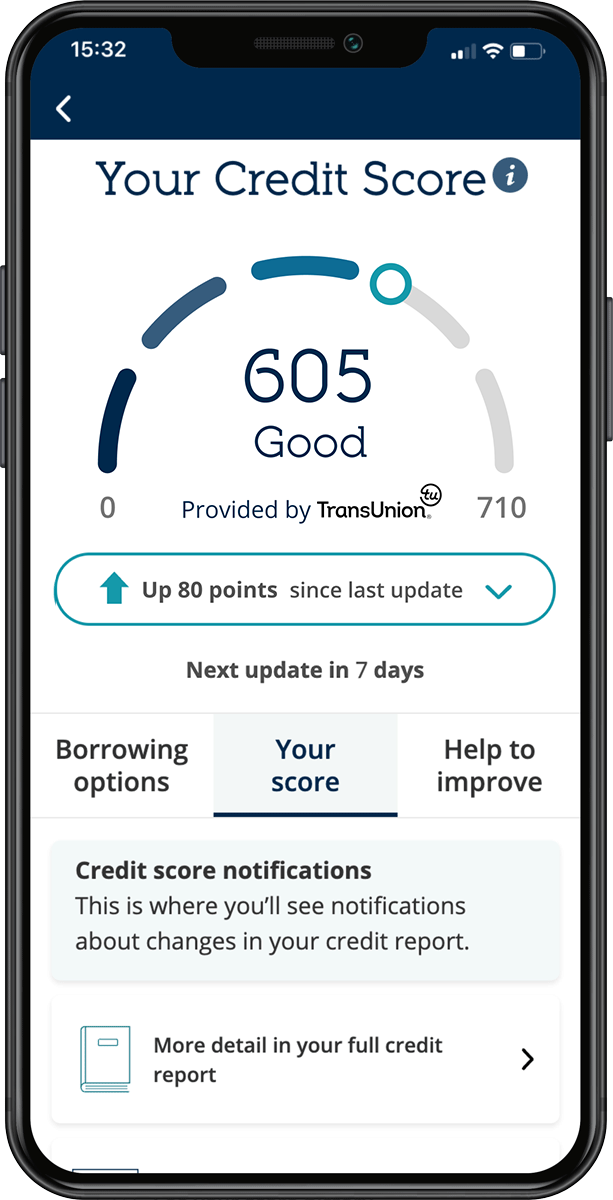

Know where you stand with MBNA

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.