Why your credit application might be turned down

It can be disappointing if you didn’t get what you were hoping for. Here are some of the most common reasons why.

Your eligibility could be affected for a number of reasons:

Lenders have their own scoring systems when considering credit applications and will usually look at…

- Your affordability. What you can afford to repay based on what you earn and spend, and any existing debt.

- Your details. Personal information, such as your address and employment status.

- Your account history. Records of previous accounts held with them.

If you have been declined credit, you might like to see your credit report. You can contact a credit reference agency, such as TransUnion, to view your credit report. You could learn how to make improvements which might help you in the future.

Keep reading

Know where you stand with MBNA

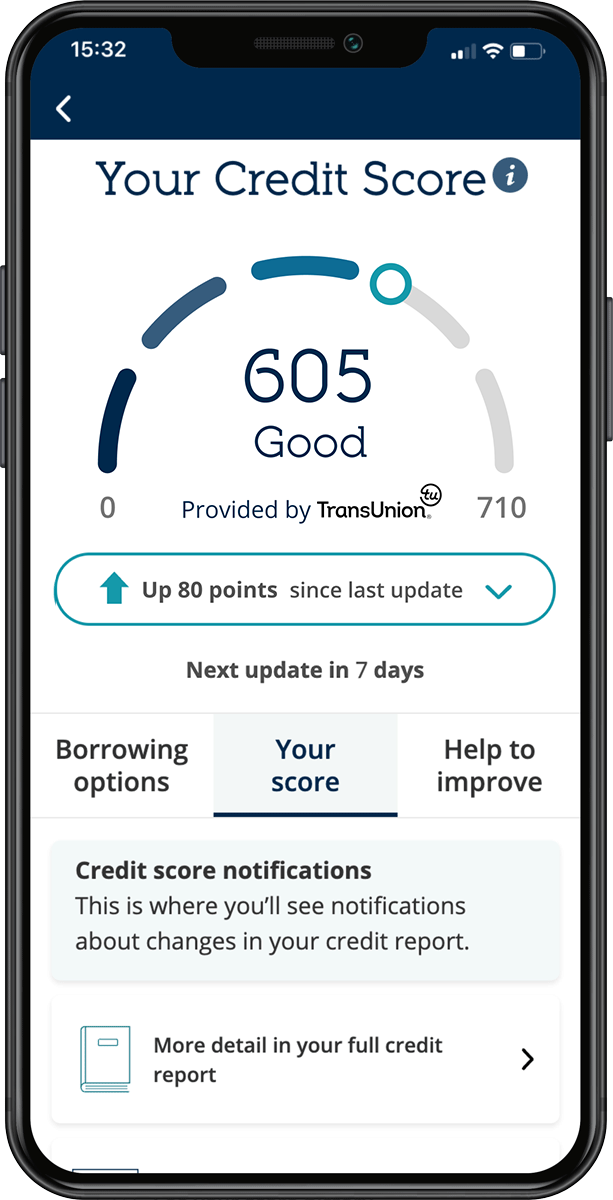

Sign up for ‘Your Credit Score’. We’ve partnered with TransUnion to provide you with access to your credit score. It’s free to use and won’t impact your credit file.

- View your updated credit score every 7 days.

- See what you’re doing well.

- Understand what you can do that might help to improve your score.

- Find out how your score compares to the UK average.